LONDON, Ontario–(BUSINESS WIRE)–All amounts are unaudited and in Canadian dollars and are based on financial statements prepared in compliance with International Accounting Standard 34 Interim Financial Reporting, unless otherwise noted. Our first quarter 2018 (“Q1 2018”) unaudited Interim Consolidated Financial Statements for the period ended January 31, 2018 and Management’s Discussion and Analysis, are available online at www.versabank.com/investor-relations and at www.sedar.com. Supplementary Financial Information will also be available on our website at www.versabank.com/investor-relations.

VersaBank, (“VB” or the “Bank”), (TSX:VB), today reported net income of $4.0 million for the quarter, compared to $11.9 million for the same period last year, which reflected the Bank recognizing $8.8 million in deferred income tax assets in January 2017.

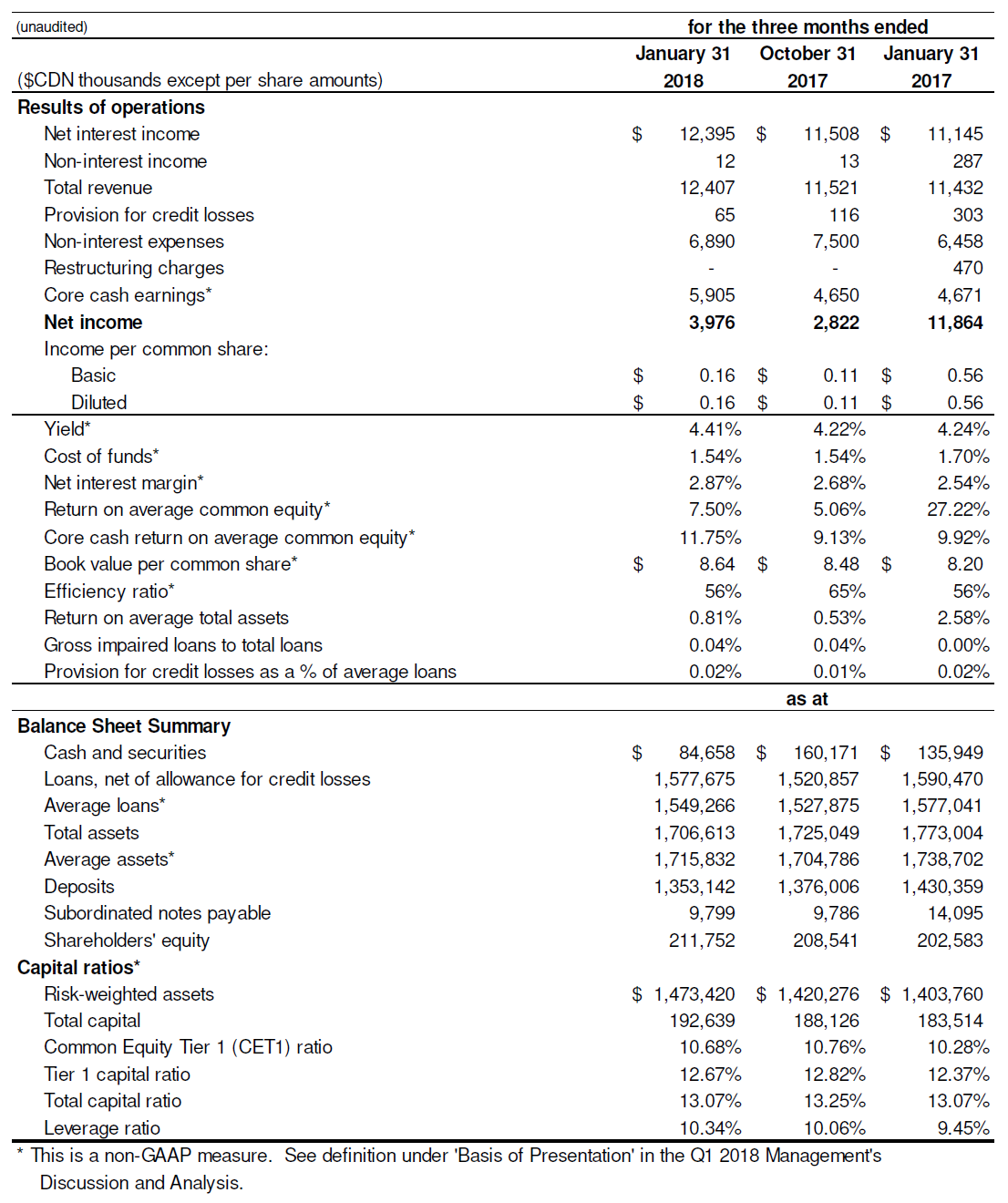

Core cash earnings for the quarter was up 26% to $5.9 million from $4.7 million for the same period last year. Core cash earnings, which reflects the Bank’s core operational performance and earnings capacity, is calculated as net income adjusted for income taxes, restructuring charges, corporate projects and other non-core operational expenses (see core cash earnings reconciliation below) (2).

Mr. David Taylor, President & CEO commented, “Our Bank’s model of using advanced technologies to serve niche markets is continuing to demonstrate its tremendous power. This is evidenced by the Bank accomplishing quarter over quarter core cash earnings growth of 27%, building off the amazing 50% four year compound annual growth rate (“CAGR”) trajectory that was achieved at the end of our last fiscal year.

Despite the two recent increases in the Bank of Canada rate our Bank was able to maintain its very low cost of funds and increase its net interest margin (“NIM”) for the quarter to an industry leading 2.87%, all while maintaining a highly disciplined approach to credit risk management as demonstrated by the Bank’s exceptionally low provision for credit losses. Further, net income for the quarter was up 41% to $4.0 million from $2.8 million last quarter driven primarily by a 7% increase in NIM, and an 8% decline in non-interest expenses over the same period.

Our Bank was formed to explore, and if appropriate apply digital technologies to areas of traditional banking where we thought we could provide a better product or service. Early in our history, we created a new method of digitally acquiring deposits and later a new method of acquiring loan and lease receivables. Both of these ground breaking initiatives are working out very well and are now giving rise to outstanding profit margins and growth. Not content to ‘rest on our laurels’ we decided to explore the application of digital technology to another traditional service that banks have been providing for centuries, that being custodial services. Considering the tremendous growth in ‘digital valuables’ we decided to build a digital storage facility or “digital safety deposit box”. This new initiative is taking place in a wholly owned subsidiary of the Bank that we have called VersaVault Inc. Since the announcement of VersaVault (“VV”), we have received considerable interest in our new product and are looking forward to having a prototype ready this coming spring. We expect incremental costs associated with the creation of VV to be minimal.”

|

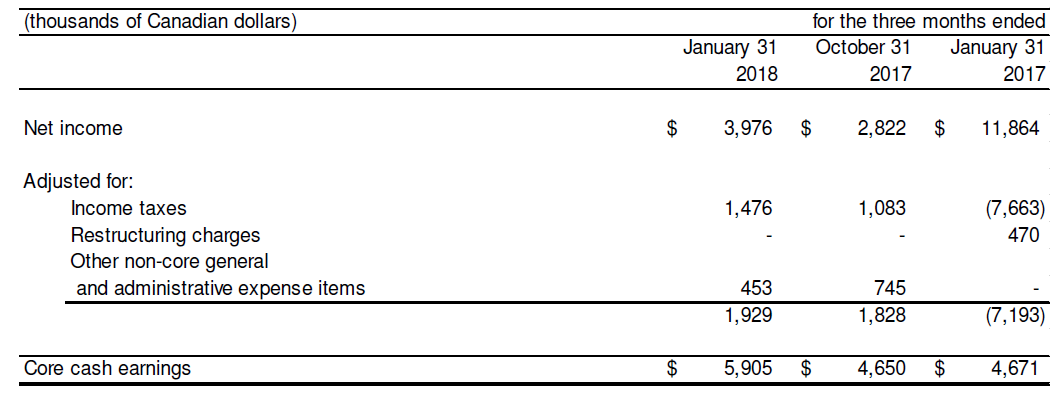

Q1 2018 compared to Q1 2017(1) |

Q1 2018 compared to Q4 2017(1) |

|

|

(1) Certain highlights include non-GAAP measures. See definition under ‘Basis of Presentation’ in the Q1 2018 Management’s Discussion and Analysis.

(2) Core cash earnings is calculated as:

(3) The year ago earnings include the recognition of $8.8 million in deferred income tax assets in January 2017.

Q1 2018 Business Operations

VersaBank, is a technology based, digital Canadian Schedule I chartered bank. It operates using an “electronic branchless model” and sources its funding, along with consumer and commercial loan and lease receivables, electronically. VersaBank also makes residential development and commercial mortgages it obtains through a well-established network of brokers and through direct contact with its lending staff.

Commercial Banking – Loans are originated through direct contact with the Bank’s clients and through mortgage brokers and syndication partners. Loans are conservatively secured by real estate primarily in Ontario and occasionally other areas of Canada. Assets at January 31, 2018, totaled $721 million, up 4.19% from last quarter and down 3.84% from a year ago.

eCommerce – Small loan and lease receivables are electronically purchased from VB’s vendor partners who originate point of sale loans and leases in various markets throughout Canada. Assets at January 31, 2018 totalled $839 million, up 3.43% from last quarter and up 1.95% from a year ago.

Funding – VB has established three core funding channels, those being personal deposits, commercial deposits, and cash holdbacks retained from the Bank’s receivable purchase program originator partners that are classified as other liabilities. Personal deposits, consisting principally of guaranteed investment certificates, are sourced primarily through a well-established and well-diversified deposit broker network that the Bank continues to grow and expand across Canada. Commercial deposits are sourced primarily via specialized chequing accounts made available to insolvency professionals (“Trustees”) in the Canadian insolvency industry. The Bank developed customized banking software for use by Trustees that integrates banking services with the market-leading software platform used in the administration of consumer bankruptcy and proposal restructuring proceedings. VB’s cost of funds for the quarter was 1.54%, unchanged from last quarter and down 16 bps from a year ago. VB’s low cost of funds enables it to earn industry leading NIM without taking on increased credit risk typically necessary to achieve higher yields.

Capital – As at January 31, 2018, VB’s CET1 ratio was 10.68%, down 8 bps from last quarter and up 40 bps from a year ago. VB, like most small banks, uses the Standardized Approach to calculate its risk weighted assets and because VB focuses on commercial and consumer loans with lower than average risk (as demonstrated by its long history of low provision for credit losses), it believes the Standardized Approach does not properly reflect the intrinsic risk in its lending assets. As a consequence, VB’s leverage ratio is conservative, being more than twice the average leverage ratio of the major Canadian banks, which use the AIRB approach to calculate their risk weighted assets.

Credit Quality – For the quarter ended January 31, 2018 the Bank recorded a net provision for credit losses (“PCL”) in the amount of $65,000 compared to $116,000 last quarter and $303,000 a year ago. Further, as at January 31, 2018, total gross impaired loans were approximately 0.04% of total lending assets and the Bank’s PCL as a percentage of average loans continues to be one of the lowest in the industry at 0.02%, which is approximately one tenth of what is reported by the major Canadian banks, reflecting the very low risk profile of the Bank’s lending portfolio. VB’s business strategy involves taking lower credit risk, but achieving greater NIM by lending in niche markets that are not well served by the larger financial institutions.

VersaVault Inc.—VersaVault Inc. (“VV”) is a wholly owned subsidiary of the Bank and was formed to create a highly secure and private digital storage facility. VV is targeting spring to have a prototype ready for testing.

FINANCIAL HIGHLIGHTS

Forward-Looking Statements

The statements in this press release that relate to the future are forward-looking statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, many of which are out of our control. Risks exist that predictions, forecasts, projections and other forward-looking statements will not be achieved. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited to, the strength of the Canadian economy in general and the strength of the local economies within Canada in which we conduct operations; the effects of changes in monetary and fiscal policy, including changes in interest rate policies of the Bank of Canada; global commodity prices, the effects of competition in the markets in which we operate; inflation; capital market fluctuations; the timely development and introduction of new products in receptive markets; the impact of changes in the laws and regulations regulating financial services; changes in tax laws; technological changes; unexpected judicial or regulatory proceedings; unexpected changes in consumer spending and savings habits; and our anticipation of and success in managing the risks implicated by the foregoing. For a detailed discussion of certain key factors that may affect our future results, please see our annual MD&A for the year ended October 31, 2017.

The foregoing list of important factors is not exhaustive. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The forward-looking information contained in the management’s discussion and analysis is presented to assist our shareholders in understanding our financial position and may not be appropriate for any other purposes. Except as required by securities law, we do not undertake to update any forward-looking statement that is contained in this management’s discussion and analysis or made from time to time by the Bank or on its behalf.

Visit our website at: http://www.versabank.com

Contacts

VersaBank

Investor Relations:

Wade MacBain, (800) 244-1509

[email protected]